iDEAL

Overview - iDEAL

iDEAL is the most popular payment method in the Netherlands and is a real-time bank transfer system covering all major Dutch consumer banks. 59% of all online transactions in the Netherlands are done using iDEAL.

A customer will be redirected to his bank in order to intiate the bank transfer from their bank account to the merchant using the online banking credentials. The authentication of the transfer will be done via PIN & TAN, which makes the method very secure for consumers but also merchants. The payments are guaranteed as they are debited directly from the customer's bank account and there won't be any chargebacks.

The following issuing banks are supported by iDEAL.

- ABN AMRO

- ASN Bank

- bunq

- ING

- knab

- Rabobank

- Regio Bank

- SNS Bank

- Triodos Bank

- Van Lanschot Bankiers

- Handelsbanken

To accept iDEAL payments, a merchant must usually sign up with a certified iDEAL acquiring bank who is responsible for the clearing & settlement with the issuer (customer bank). This requires the merchant to hold a local Dutch bank account with the acquiring bank.

Concardis offers a different solution and collects the iDEAL funds directly from the customers. The funds can then be settled to the merchant without the need of having a specific bank account in the Netherlands.

The collecting solution offers another advantage as a merchant can also easily execute refunds for iDEAL payments which are not supported by default by the iDEAL scheme. Our iDEAL refunds will be processed as a SEPA credit tansfer to the IBAN from the iDEAL online payment that will be stored securely within the Payengine.

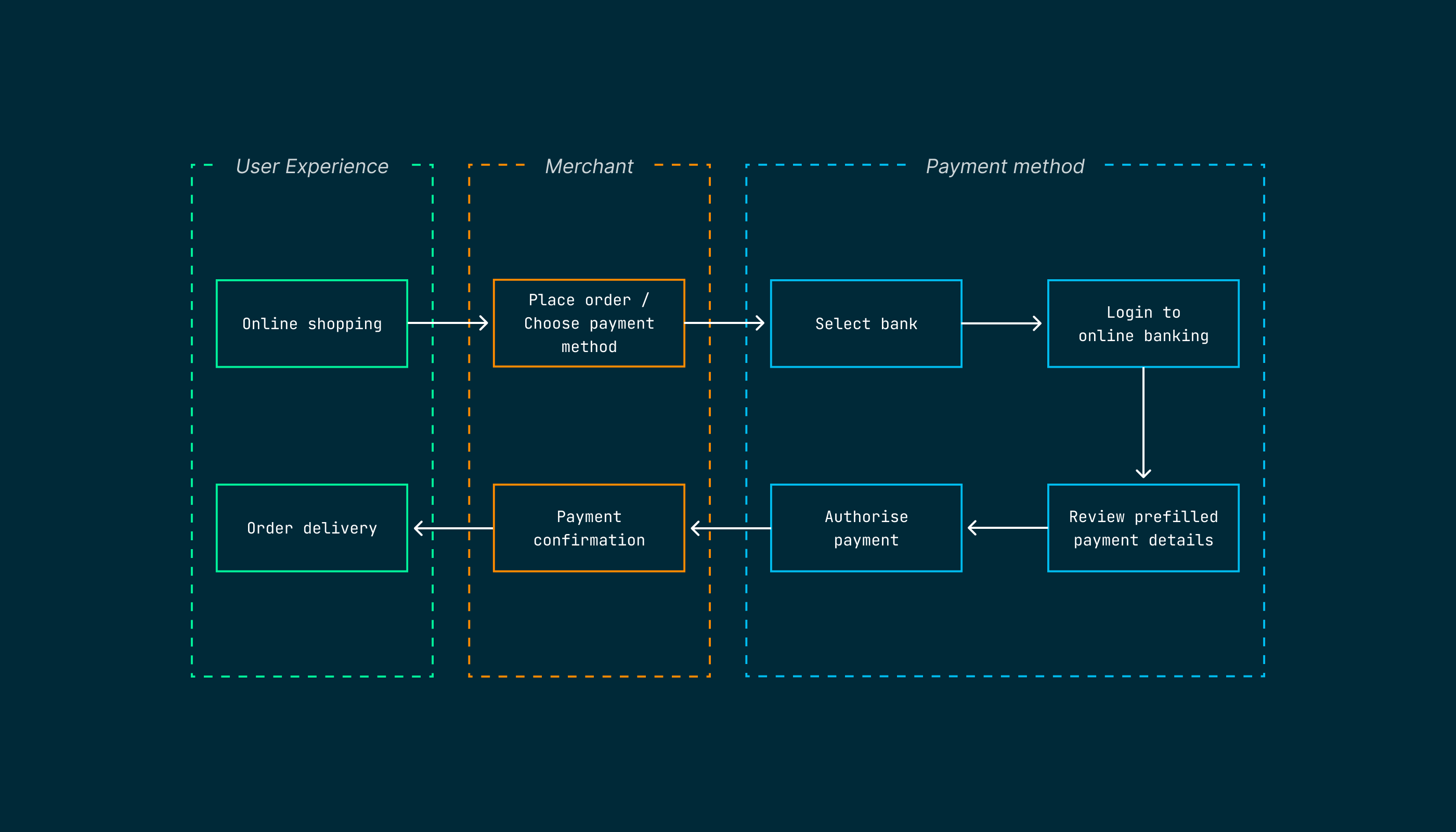

Customer Experience - iDEAL

Customer Flow in the Payenegine Widget

| Step | Description | Image |

|---|---|---|

| 1 | Select iDEAL. |  |

| 2 | Select bank. |  |

| 3 | Redirect to bank. |  |

In customer's online Bank Account; following the steps, customer can pay for his purchase.

Feature Details - iDEAL

General

| Name | Details |

|---|---|

| Product | iDEAL |

| Type | SEPA |

| Channels | ECOM |

| Currencies | EUR |

| Countries | NL |

| Technical Flow | Asynchronous |

| Recurring | No |

| Chargebacks | No |

Supported Features and Services

| Name | Details |

|---|---|

| Debit | Yes |

| Preauthorization | No |

| Cancelation | No |

| Capture | No |

| Refunds | Yes |

| Notifications | Yes (webhook and email) |

| Settlement Reporting | Yes (Unified Settlement Reporting) |

Integration Types

| Name | Details |

|---|---|

| API | Yes |

| Widget | Yes |

| Bridge | No |

| Shop Plugin | No |

| Paylink | Yes |

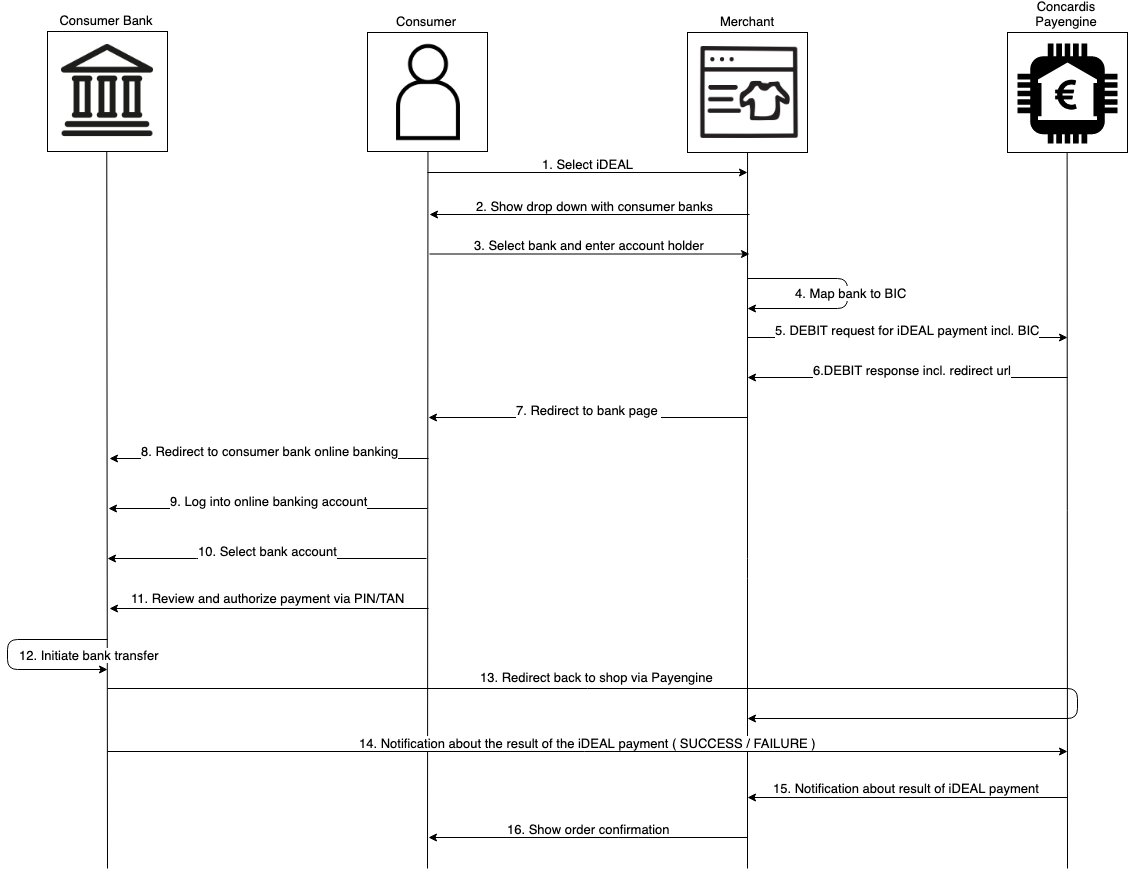

Integration via API - iDEAL

Technical Flow

Note: In case a merchant integrates via the Payengine widget solution steps 2, 4 and 5 will be handled by the widget.

Webhook Notifications

As it is not ensured at the time of the redirect to the shop that the payment was 100% successful the Payengine waits for the final asynchronous notification from the bank before a status is moved from PENDING into SUCCESS or FAILURE.

A merchant should register for the Payengine webhook notifications in order to receive this final status update. A GET on the order or DEBIT transaction would also work, but it is not ensured that the final status will be available immediately after the redirect and a merchant might have to query the GET multiple times. Therefore it is strongly recommended that the asynchronous notifications from the Payengine are used insted.

The notifications could be subscribed:

- via the payengine API (link to API documentation)

- via the Payengine Merchant Center (link to Merchant Center notifications documentation)

The following events have to be subscribed for in order to receive the iDEAL notifications, depending on the preferred source of notification.

| Source | Event |

|---|---|

| API | notificationState = UPDATED |

| Merchant Center | event type = order update success event type = order update failure

|

Specifications - iDEAL

iDEAL input parameters

The following input parameters are required for initiating an iDEAL payment via direct API integration.

| Parameter | Mandatory/Optional (M/O) | Description | Example |

|---|---|---|---|

| payment.bic | M | BIC (8 or 11 alphanumeric letters) of consumer’s bank | RABONL2U |

| payment.accountHolder | O | Name of the bank account holder | John Doe |

| payment.successUrl | M | Redirect URL for successful payment | http://my.shop.com/success |

| payment.failureUrl | M | Redirect URL for unsuccessful payment | http://my.shop.com/fail |

| payment.cancelUrl | M | Redirect URL when payment is canceled | http://my.shop.com/cancel |

Selection of iDEAL banks

If the integration is done directly via the Payengine API and not via the widget solutions it has to be ensured that the consumer bank information is collected in the checkout.

In this case it is recommended to let the consumer select the bank via a dropdown and the shop then sends the corresponding BIC to the Payengine. The list of supported banks and BIC can be found below.

| Bank Name | BIC |

|---|---|

| Rabobank | RABONL2U |

| ABN AMRO | ABNANL2A |

| Van Lanschot Bankiers | FVLBNL22 |

| Triodos Bank | TRIONL2U |

| ING Bank | INGBNL2A |

| SNS Bank | SNSBNL2A |

| ASN | ASNBNL21 |

| RegioBank | RBRBNL21 |

| Knab | KNABNL2H |

| Bunq | BUNQNL2A |

Samples

iDEAL Debit Request

{ "product" : "ideal", "initialAmount": 1190, "currency": "EUR",

iDEAL Debit Response

{ "createdAt": 1553174021405, "modifiedAt": 1553174021412, "merchantId": "merchant_bzo3pt4dir",

Settlements

All settlement information will be provided in the Unified Settlement Report. The format and mappings can be found in the corresponding documentation (see Unified Settlement Report).