Unified Settlement Report

Introduction

The Unified Settlement Report is a comma separated file format (CSV). that maps multiple settlement reports from external processors (e.g. PayPal, Concardis, SEPA, ...) into one unified format for all payment methods and processors. This simplifies the reconciliation processes for merchants as they only have to handle one file format.

There will be separate Unified Settlement Report files on a processor level to ensure that merchants can directly start the reconciliation process, rather than waiting a full day until all settlement files from the various processors are collected and can be reported within one file.

The files will be generated on a daily base in case the processor offers a daily settlement reporting.

Formatting Instructions

We distinguish between alphanumeric (AN) and numeric (N) parameters within the Unified Settlement Report.

| Parameter Types | Description | Sample |

|---|---|---|

| AN - Currency | ISO 4217 - A3 currency code | EUR |

| AN - Rest | Alphanumeric values comming from the Payengine will follow the format restrictions defined by the Payengine API. Alphanumeric values received from the processors will just be forwarded as they are. | |

| N - Amounts | Amount parameters will use the . as a decimal separator and can include as much decimal places as supported by the currency and provided by the processor. There is no separate credit/debit sign, negative settlement amounts will include a - | -10.25N |

| N - Dates | Date parameter will follow the format DDMMYYYY | 15012019 |

Even if there is a predefined Unified Settlement Report format the content of the file may differ based on the payment method or processor.

This means that not all transaction types will be supported for all methods/processors but also that not all parameters will always be populated.

Specific instructions and mappings can be found in the corresponding subsections for the methods/processors including some samples.

Settlement Details Record

Field 1 - 8

| Field No | Field Name | Description | Type | Sample |

|---|---|---|---|---|

| 1 | Record Type | The record type, hardcoded to 'sett_dtl' for settlement details | AN | sett_dtl |

| 2 | Merchant Id | The Payengine merchantId | AN | Merchant-000cf2c9-66fe-4730-ac9e |

| 3 | Source File Id | Payengine identifier of source settlement file | AN | jgrwsntrjt |

| 4 | Payment Method | The payment method, e.g. card, paypal, sepa | AN | paypal |

| 5 | Payment Brand | The payment brand, e.g. visa, mastercard | AN | paypal |

| 6 | Order Id | The Payengine orderId | AN | auap9iftmn |

| 7 | Transaction Id | The Payengine transactionId | AN | transaction_jgrwsntrjt |

| 8 | Merchant Reference | The Payengine merchantOrderId provided by the merchant | AN | 1234567890 |

Field 9

Field Name: Type Type: AN Sample: settlement

| Type (Field Name: type) | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| settlement | successfully settled captures and debits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| reject | technically rejected capture, debit or refund request by the acquirer, rejects do not have any impact on the payout | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| refund | successfully settled refunds | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| dispute | disputed settlements, can have positive or negative impact on balance depending if they are hold or released | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| chargeback | chargeback information in case of fraudulant transactions | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| chargeback_reversal | a reversal of a chargeback | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| adjustment | adjustments on the merchant account | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| fee | separate fees that cannot be associated directly to any other transaction type | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| vat | separate VAT or tax that cannot be associated directly to any other transaction type | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Field 10 - 31

| 10 | Transaction Date | Original transaction date of the capture/debit transaction, format DDMMYYYY | N | 20082018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | Transaction Currency | Original transaction currency of the capture/debit transaction (ISO 4217) | AN | GBP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | Transaction Amount | Original transaction amount of the capture/debit transaction, including sign, decimal places will be split by ., e.g. 15.99 | N | 180.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | Settlement Date | Date when funds are settled to the merchant account, format DDMMYYYY. For methods where an acquirer is involved the settlement date doesn't necessarily has to be the actual payment date | N | 23082018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | Settlement Currency | Currency of the settlement (ISO 4217) | AN | EUR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15 | Settlement Gross Amount | Gross amount in settlement currency | N | 200.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 16 | Settlement Net Amount | Net amount in settlement currency | N | 198.12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17 | Settlement Fx Rate | Exchange rate in case transaction and settlement currency differ | N | 0.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 | Commission | The commission fee that was withheld by the acquirer/processor. Cards: If the acquirer provides the transaction information at interchange level we the fee details will be available in the separate fields for: Aqcuirer Service Fee, Scheme Fees, Interchange | N | -1.88 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Processor Specific Instructions

As the Unified Settlement Report is based on a generic format covering multiple payment methods not all of the parameters are applicable for each method and processor. The table below will give an overview which parameters can be expected for which processor. Additionally the following subsections will explain specific mappings on a processor level.

| Field No | Parameter types | Concardis | PayPal | PPRO | Prepayment | SEPA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Record Type | yes | yes | yes | yes | yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Merchant Id | yes | yes | yes | yes | yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Source File Id | yes | yes | yes | yes | yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Payment Method | yes | yes | yes *1 | yes | yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Payment Brand | yes *1 | yes | yes *1 | yes | yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | Order Id | yes *1 | yes *1 | yes *1 | yes | yes *1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Transaction Id | yes *1 | yes *1 | yes *1 | yes | yes *1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Merchant Reference | yes *1 | yes *1 | yes *1 | yes | yes *1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | Type | yes | yes | yes | yes | yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- only transaction level / 2) availability depending on agreed pricing model / 3) PPRO: only for type=fee / 4) PPRO: only for type=chargeback / 5) PPRO: only for type=clearing / 6) SEPA: only for type=settlement & reject

Concardis

Supported Types

The following transaction types will be supported:

- settlement

- refund

- chargeback

- adjustment

- fee

- unknown

Payment Method & Brand

The following payment method and brand values will be supported:

| Parameter method | Payment brand | Description |

|---|---|---|

| card | diners | Diners settlement information |

| card | discover | Discover settlement information |

| card | jcb | JCB settlement information |

| card | maestro | Maestro settlement information |

| card | mastercard | Mastercard settlement information |

| card | visa | Visa settlement information |

| card | visaelectron | Visa Electron settlement information |

| card | empty | In case of aggregated or non transaction related records, e.g. fee, there won’t be any brand associated and the field will be empty. |

Special Mapping

| Parameter | Content |

|---|---|

| Payment Provider Merchant Id | VP Number |

| Payment Provider Reference | GUID of transaction |

| Payment Provider Additional Reference 1 | Acquirer Reference Number (ARN) |

| Payment Provider Settlement Batch Id | GUID Settlement |

PayPal

Supported Types

The following transaction types will be supported:

- settlement

- refund

- dispute

- chargeback

- adjustment

- fee

- clearing

- unknown

Payment Method & Brand

Concardis Samples

settlement: sett_dtl,merchant_qxx92nloob,settlementdata_afkliemmcv,card,visa,auap9iftmn,transaction_jgrwsntrjt,merchantOrderId1547451,settlement,02012019,EUR,170.00,04012019,EUR,170.00,169.14,,-0.72,-0.06,-0.15,-0.51,-0.14,141952334,005056927B1F1EE985AFD3037900FE05,15423999011000515990924,,0050568645AC1EE8B4D3EBA5BD63EFBA,,,52K25161,05012019 sett_dtl,merchant_qxx92nloob,settlementdata_afkliemmcv,card,mastercard,qmwutfgnt2,transaction_sdhgklilt,merchantOrderId1547452,settlement,02012019,EUR,41.13,04012019,EUR,41.13,40.92,,-0.18,-0.02,-0.04,-0.12,-0.03,144171709,005056927B1F1EE985AFC410253CDDD4,74627649011000515980372,,0050568645AC1EE8B4D3EBA5BD63EFBA,,,52K25165,05012019

| Parameter method | Payment brand | Description |

|---|---|---|

| paypal | paypal | PayPal settlement information |

Special Mapping

| Parameter | Content |

|---|---|

| Payment Provider Merchant Id | PayPal: Account ID |

| Payment Provider Reference | PayPal: Transaction ID |

| Payment Provider Additional Reference 1 | PayPal: Reference ID |

| Payment Provider Reason Code | PayPal: Transaction Event Code |

PayPal Samples

settlement: sett_dtl,merchant_qxx92nloob,settlementdata_afkliemmcv,paypal,paypal,auap9iftmn,transaction_jgrwsntrjt,merchantOrderId1547451,settlement,02012019,EUR,125.75,04012019,EUR,125.75,123.01,,-2.74,,,,,22ZQQNM56DGRN,4K247452TP309993Y,6SJ033313V4621641,,,T0003,,, refund:

PPRO

Supported Types

The following transaction types will be supported:

settlement refund chargeback fee clearing holdback unknown

| Parameter method | Payment brand | Description |

|---|---|---|

| alipay | alipay | Alipay settlement information |

| bancontact | bancontact | Bancontact settlement information |

| ideal | ideal | iDEAL settlement information |

| wechat-pay | wechat-pay | WeChat Pay settlement information |

| unknown | unknown | Only in case there is a transaction for an unknown payment method in the file. This should usually never happen! |

| empty | empty | In case of aggregated or non transaction related records, e.g. clearing, there won’t be any method or brand associated and the fields will be empty. |

Special Mapping

| Parameter Types | Description |

|---|---|

| Payment Provider Merchant Id | PPRO: Merchant ID |

| Payment Provider Reference | PPRO: Transaction ID, Only provided for type=settlement, refund, chargeback |

| Payment Provider Additional Reference 1 | PPRO: Event Type, Only provided for type=settlement, refund, chargeback |

| Payment Provider Additional Reference 2 | PPRO: Fee Type, Only provided for type=fee |

| Payment Provider Reason Description | PPRO: Chargeback Reason, Only provided for type=chargeback |

PPRO - Sample

settlement: sett_dtl,merchant_oju0ku4pjx,settlementdata_b9lq8ux7lr,ideal,ideal,olwlalnhvo,transaction_93z5qkaqtg,merchantOrderId1547569496,settlement,15012019,EUR,11.9,15012019,EUR,11.9,,,-0.45,,,,,MERCHANTTESTCONTRACT,103736117,,,,,,, refund:

Prepayment

Supported Types

The following transaction types will be supported:

- settlement

Payment Method & Brand

The following payment method and brand values will be supported:

| Parameter method | Payment brand | Description |

|---|---|---|

| prepayment | prepayment | prepayment settlement information |

Special Mapping

| Parameter Types | Description |

|---|---|

| Payment Provider Reference | Payment descriptor (Verwendungszweck) |

| Payment Date | Value date |

Prepayment - Sample

settlement: sett_dtl,merchant_qprmbcywcv,settlementdata_fs4ydgzbt5,prepayment,prepayment,3hgopm0fzu,transaction_lendbutrsj,1549351925,settlement,03022019,EUR,10.0,05022019,EUR,10.0,,,,,,,,,Svwz+3hgopm0fzu,,,,,,,06022019

SEPA Direct Debit

SEPA direct debits will be collected through an Concardis owned bank account and from there paid out to the merchant. The collection and the payouts will be done on a daily base (bank working days), however all payouts will be done based on a merchant specific configured delay.

Any incoming rejects will be subtracted from the payout amount.

Sample:

T+0* SEPA direct debits transactions are sent to the Payengine T+1: SEPA direct debit funds will be collected via a daily batch T+2: bank statement received including successfully processed and rejected SEPA direct debit payments T+10: the funds received on T+2 will be paid out as a bulk payment to the merchant

- "T+0" means transaction day + 0 days

Any chargebacks that the Payengine receives after the corresponding collected funds have been paid out to the merchant already will be charged in a bulk at the end of the month including the bank fees.

Additionally all bank fees related to rejects will also be charged at the end of the month together with the chargebacks. The bank fees won't be deducted from the payout amount!

Supported Types

As we have two different money flows (1: direct debit collection & payout, 2: chargebacks & bank fees) these signals will be presented in separate files.

unified-sepa-dd-[merchantId]-[date].csv unified-sepa-chargeback-[merchantId]-[date].csv

| Transaction Type | Description |

|---|---|

| settlement | successfully funded SEPA direct debit transaction to Concardis |

| reject | rejected SEPA direct debit transaction |

| clearing | instruction about the bulk payout to the merchant |

| chargeback | SEPA chargeback transaction |

| fee | fee transaction associated to a rejected SEPA direct debit transaction |

| Parameter method | Payment brand | Description |

|---|---|---|

| sepa | sepa | SEPA settlement information |

Special Mapping

| Parameter | Content |

|---|---|

| Commission | Bank fees for rejected direct debit transactions, only applicable for type=chargeback |

| Payment Provider Merchant Id | Merchant Number |

| Payment Provider Reference | EndToEndId for the direct debit transaction, not applicable for type=clearing |

| Payment Provider Additional Reference 1 | Mandate ID, not applicable for type=clearing |

| Payment Provider Settlement Batch Id | EndToEndId for merchant payout, only applicable for type=settlement & clearing |

| Payment Provider Reason Code | SEPA Return Reason Code |

| Payment Provider Reason Description | SEPA Return Additional Info |

| Payment Date | the calculated date of the payout (based on configured delay), only applicable for type=settlement |

Further Notes:

- The transaction types settlement & reject won't include any bank fee information in the unified settlement.

- For chargeback transactions the Settlement Gross Amount will contain the actual amount charged back and the Commission field will contain all the corresponding bank fees

- All fee transactions will include the Payengine details pointing to the corresponding reject transaction and the Settlement Gross Amount will contain the actual bank fee amount.

SEPA Direct Debit - Sample - unified-sepa-dd-[merchantId]-[date].csv:

settlement: sett_dtl,merchant_qxx92nloob,settlementdata_ygrzgk3mcx,sepa,sepa,4sorwbgmw9,transaction_khgyesahe3,merchantOrderId1545224327,settlement,10122019,EUR,66.0,12122019,EUR,66.0,,,,,,,,5364852,d2b0d7203bbb4c3aadf6165,mandateId1545224327,,abb0d7203bbb4c3aadf71b2,,,,20122018 reject:

SEPA Direct Debit - Sample - unified-sepa-chargeback-[merchantId]-[date].csv:

chargeback: sett_dtl,merchant_qxx92nloob,settlementdata_s0rt37hdv0,sepa,sepa,24eopplgis,transaction_8dxypvlqnd,merchantOrderId1545142410,chargeback,24102019,EUR,19.5,22112019,EUR,-19.5,,,,,,,,5833904,7b15e2c064414d46ba55829,mandateId1645224329,,,MD06,Disputed authorized transaction,, fee:

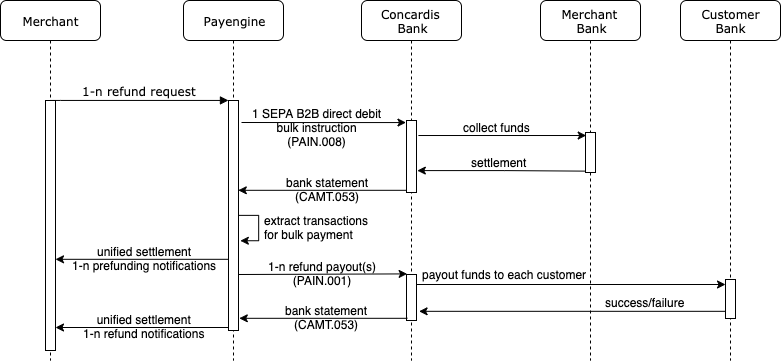

SEPA Refunds (Pre-funded)

There is an optional feature to support automated refund processing via the Payengine. In order to use the feature a merchant needs provide a SEPA B2B mandate to Concardis that the Payengine can collect the funds from a merchant account once a refund request comes in. Once the funds from the merchant are available on the Concardis bank account, the Payengine will trigger the payout/refund to the merchant's end customer. As this is a different money flow compared to the standard SEPA processing the Payengine will provide a separate unified settlement report for the pre-funded refund functionality.

- unified-sepa-refund-[merchantId]-[date].csv

The unified settlement file for the pre-funded refund feature only includes the signals that affect the money flow between the merchant's bank account and the Concardis bank account.

Supported Types

The following transaction types will be supported:

Settlement File Type:

unified-sepa-refund-[merchantId]-[date].csv

| Transaction Type | Description |

|---|---|

| prefunding | successful pre-funding for outgoing refunds on transaction level (collected via SEPA B2B bulk direct debit) |

| prefunding_failure | failed pre-funding for outgoing refunds on transaction level (collected via SEPA B2B bulk direct debit) |

| refund | successful payout/refund transaction to end customer |

| reject | rejected payout/refund transaction to end customer |

SEPA Refunds (Pre-funded) - Sample

prefunding: sett_dtl,merchant_qxx92nloob,settlementdata_lv7oo4ewiu,sepa,sepa_refund,vb4tujc3sw,transaction_85nlpond3c,merchantOrderId1545224318,prefunding,12122019,EUR,-15.6,14122019,EUR,-15.6,,,,,,,,5364852,,PEB2BMREF12345678,,4587865d7c7425786248vb,,,, prefunding_failure: