PostFinance

Overview - PostFinance

Тhe PostFinance Card is a local debit card in Switzerland issued by PostFinance. It is a popular payment method in eCommerce and more than three million PostFinance Card holders can reached.

Preconditions Merchants need a CHF business account and an acquiring contract with PostFinance to offer PostFinance Card.

Activation - PostFinance

To activate PostFinance as a payment method and to add it to your PayEngine Merchant Center, you need to complete the onboarding journey.

Please provide our support with the following information:

- PostFinance MerchantID

- Accepted Currency

If you do not yet have a PostFinance acquiring contract and CHF business account, please contact PostFinance directly.

Customer Experience - PostFinance

The following list describes a simplified payment flow using PostFinance Card.

| Step | Description | Image |

|---|---|---|

| 1 | The customer selects the PostFinance Card payment method. |  |

| 2 | The customer will be redirected to PostFinance. | |

| 3 | The customer can select the option to pay via their mobile app (option on the left) or proceed with PostFinance Card (option on the right). |  |

| 4 | When the PostFinance Card option is selected (see step 3) the cardholder has to enter the card credentials and authenticate via TAN generator or app. |  |

| ||

| 5 | Once the payment is be completed and the customer is redirected back to the shop. |  |

Note: All payments are processed by PostFinance at the end of the day and the purchase amount is debited from the cardholder account the following day. Funds are usually transferred to the seller's account the following day.

PayEngine Details - PostFinance

General

| Name | Details |

|---|---|

| Product | postfinance-card |

| Channels | ECOM |

| Currencies | CHF, EUR |

| Countries | CH |

| Technical Flow | Asynchronous |

| Recurring | No |

| Chargebacks | No |

| Reusable Payment Instruments | No |

Supported Features and Services

| Name | Details |

|---|---|

| Debit | No |

| Preauthorization | Yes |

| Cancellation | Yes (only full) |

| Capture | Yes (only full) See further notes under Specifics |

| Refunds | Yes |

| Notifications | Yes (webhook and email) |

| Settlement Reporting | No |

Integration Types

| Name | Details |

|---|---|

| API | Yes |

| Widget | Yes |

| Bridge | No |

| Shop Plugin | No |

| Paylink | No |

Integration via API - PostFinance

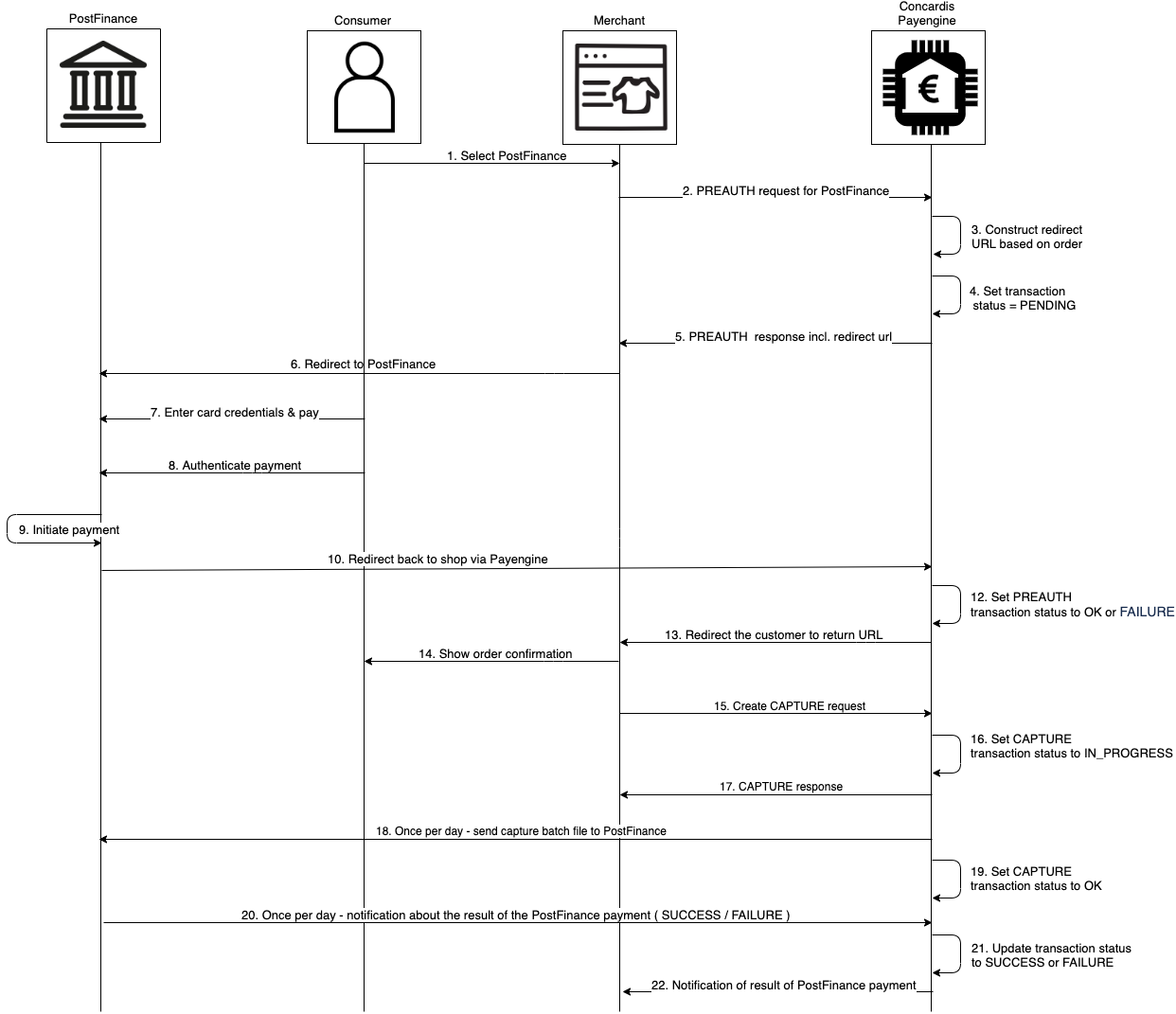

Technical Flow

Specifications - PostFinance

PostFinance processing delay

The transactions for PostFinance (capture, cancel, refund) are handled offline via batch file processing and and it can take up to 48 hours before Postfinance sends a notification about the successful transaction.

PostFinance input parameters

The following input parameters are required for initiating a PostFinance payment via direct API integration.

| Parameter | Mandatory/Optional (M/O) | Description | Example |

|---|---|---|---|

| async.successUrl | M | Redirect URL for successful payment | https://my.shop.com/success |

| async.failureUrl | M | Redirect URL for unsuccessful payment | https://my.shop.com/search/fail |

| async.cancelUrl | M | Redirect URL when payment is canceled | https://my.shop.com/search/cancel |

| payment.displayLanguage | M | One of the possible values: de, en, fr, it (there is validation on PE for permitted value) | displayLanguage : en |

| payment.displayMobileScreen | O | Optional set up for mobile view. Boolean type. | displayMobileScreen : true |

Samples

Preauth Transaction

PostFinance Preauth Request

{ "product" : "postfinance-card", "merchantOrderId": "ORDER12345", "initialAmount": 1000,

PostFinance Preauth Response

{ "createdAt": 1576849099719, "modifiedAt": 1576849099719, "merchantId": "merchant_6nqj1bh7ap",

Capture transaction

PostFinance Capture Request

{ "description": "Description for operation.", "initialAmount": 1000, "currency": "CHF",

PostFinance Capture Response

{ "createdAt": 1582298926718, "modifiedAt": 1582298926718, "type": "CAPTURE",